11+ tax equity bridge loan

No credit score required. As the margin for Low Income.

Blog Fintech Forum Europe Since 2013 Award Winning Insights On What S Next In European Fintech From The Startups Investors And Financial Institutions Making It Happen

Bridge loans are typically interest-only loans to bridge the gap between the purchase of a property and the renovation or redevelopment of the property or in some cases they used to refinance.

. A bridge loan is used by the borrower to bridge the gap between selling their existing home and putting a down payment on a new build. You can reach our expert team of. Part 1 and Part 2.

A 20 discount to the next equity round. Examples of Equity Bridge Loan Initiative in a sentence. Our group of lawyers and CPAs will help you plan for.

The EBF is used by the fund to finance projects or if necessary to pay any costs incurred upon a failed acquisition eg advisory fees. A bridge loan comes in handy if you need extra cash to. If a borrower has 61-90 days cash on hand they will receive 75 of the maximum loan.

Our home bridge loan financing program is currently available for properties located in Seattle as well as the rest of Washington State Oregon and Idaho. No income verification stated is acceptable Loans on any Washington State property. Loans from 2 to 16 years.

If the bridge load paid a. If a borrower has 91-120 days cash on hand they will receive 50 of the maximum loan. Equity Bridge Loans may be used by Borrowers andor tax credit investors as a substitute for the pay-in of equity during a projects.

Accounting Considerations For Bridge Loans. Local Processing Quick Decisions Personal Service Overview. A bridge loan is a short-term loan on your current homes equity that is used to make a down payment on a new home.

15 - 25 Points Loan Position. An Applicant requesting funds under the Equity Bridge Loan Initiative may elect points based on the amount of the requested funds and. You need a team of wealth strategists on your side one that can help reduce your tax liability and make sure you leave a lasting legacy.

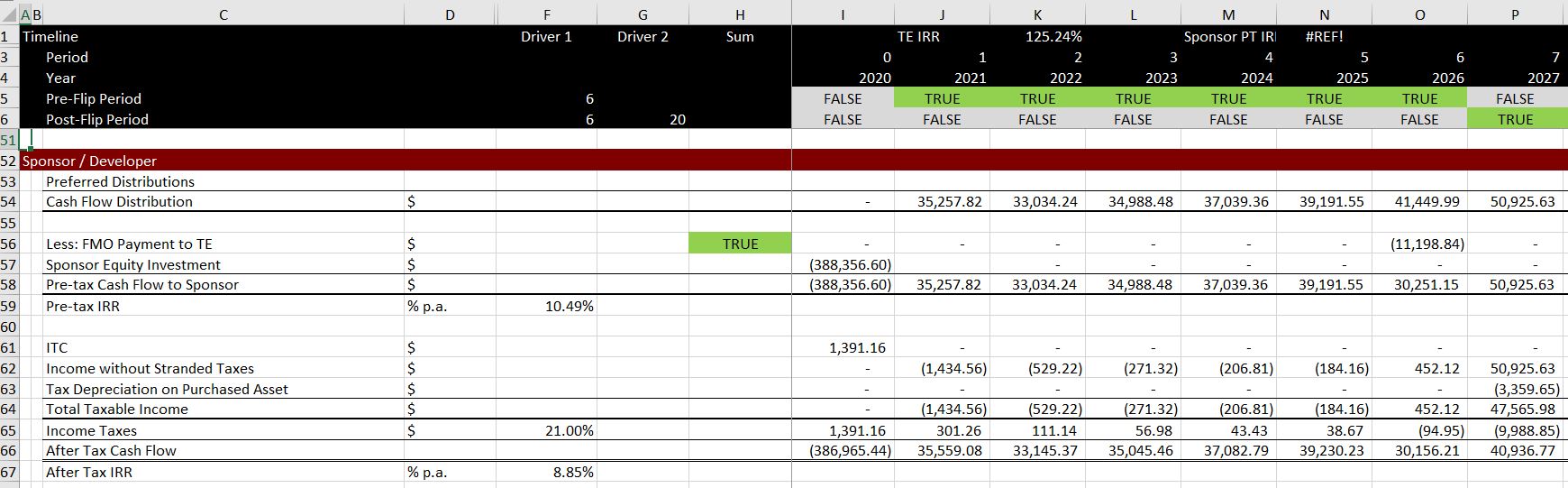

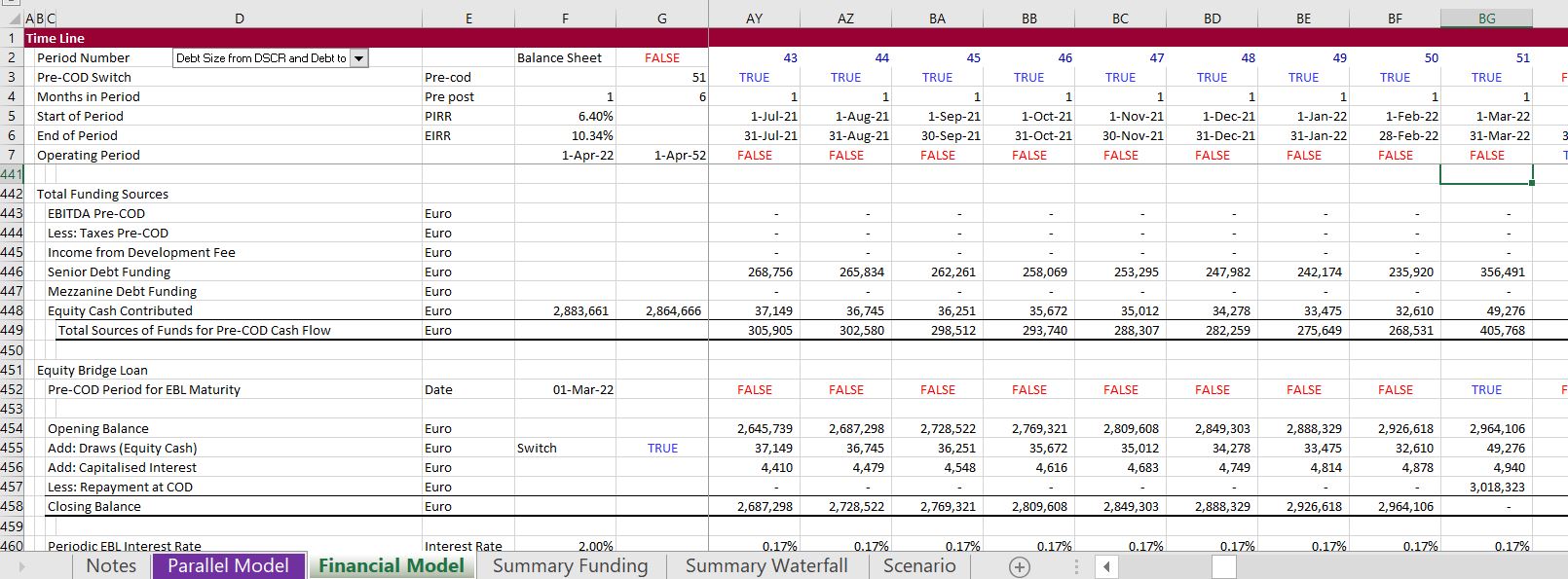

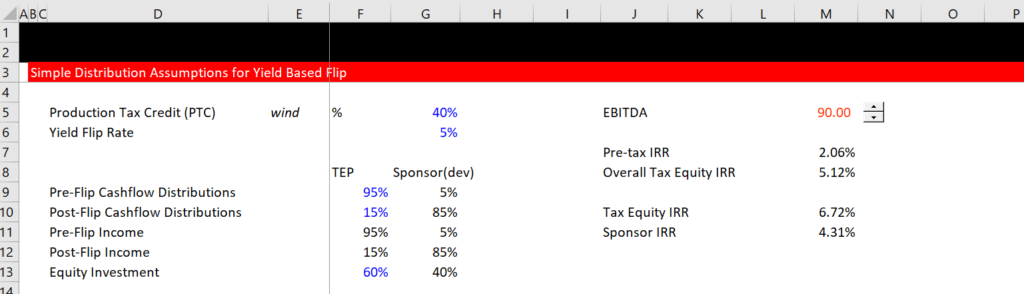

Tax-equity financing broadly encompasses investment structures in which a passive equity investor looks to achieve a target internal rate of return based primarily on US. Equity Bridge Loans EBLs in Tax Credit Projects. What is a tax equity bridge loan.

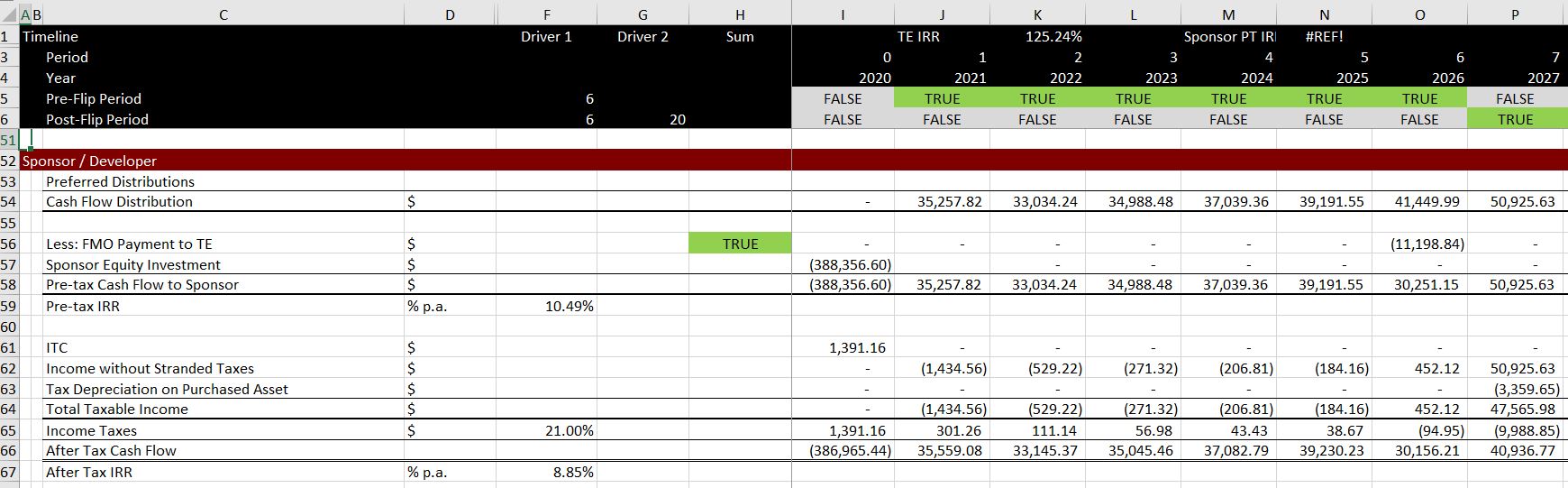

Up to 75 Interest Rates. Excel File 2 with Tax Equity Including Tax Equity Bridge Loan and Back Leverage in Quarterly Model with Corporate PPA. Fallbrooks Tax Credit Equity Bridge loan program is designed for developers with multi-family and commercial real estate projects that have been allocated state andor federal tax credits.

An increase in labor and material costs as well as rising interest rates have added significant stress in the production of affordable housing nationwide. This product uses the home equity from your current. The delay to call capital from investors improves the IRR.

Rounds of equity financing rounds from. Custom solutions to bridge the gap between your current home and the next. 1st or 2nd Loan Term12-36.

This type of financing allows. A bridge loan is a short-term loan used until a person or company secures permanent financing or removes an existing obligation. The MSHDA Equity Bridge Loan Program Statement dated January 23 2013 contains additional details relating to the requirements and terms of the MSHDA Equity Bridge Loan Program.

What is tax equity and how does it work. Competitive private money rates. 699 - 1099 Fees.

200000 - 10 Million Loan to Value LTV. The US government offers tax credits and accelerated depreciation. Bank is repaid at completion of construction with funds from tax investor who will only come in once the plant produces tax.

Company profile including profiles of your associates. Tax equity is a key tool for financing US renewable energy projects.

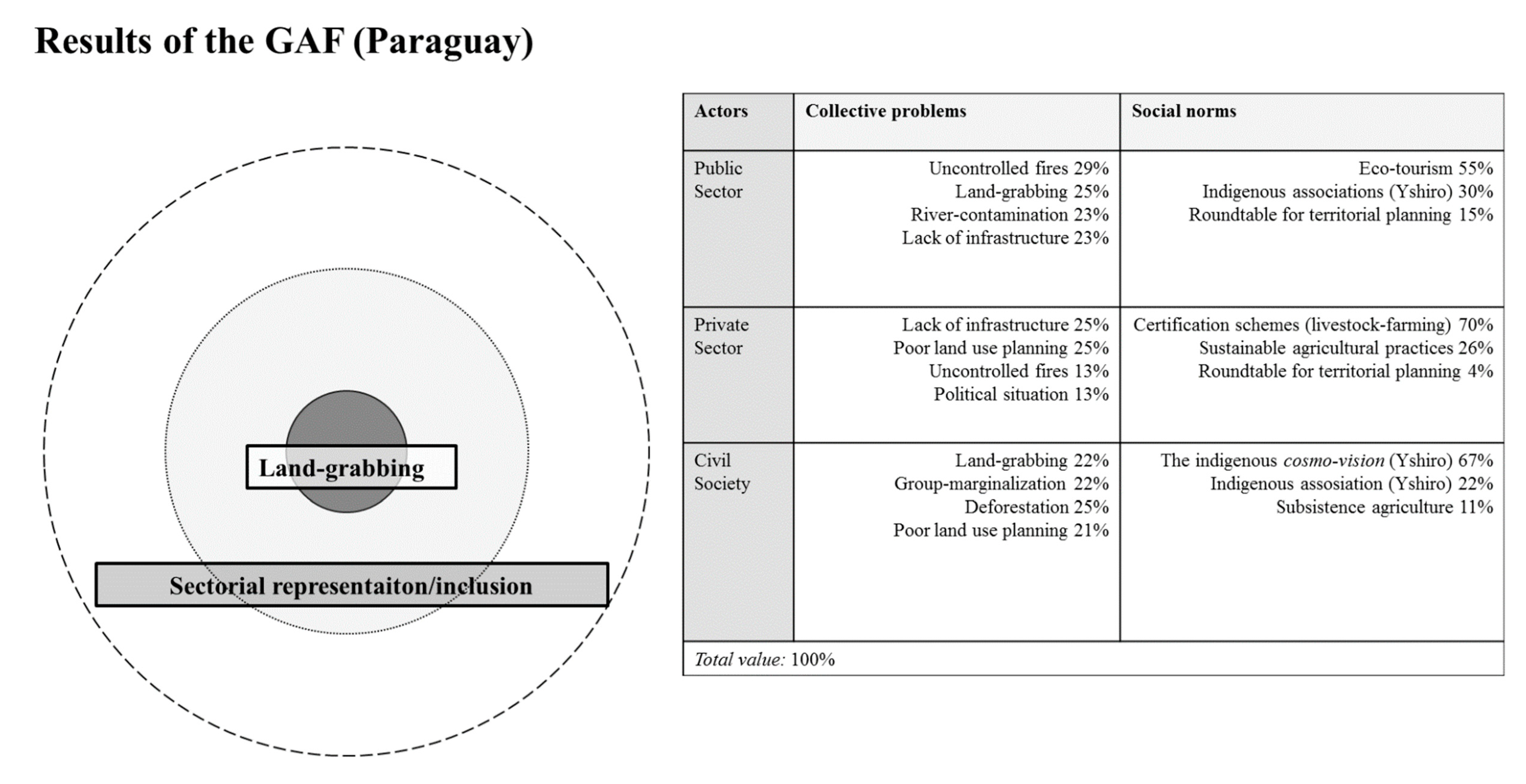

Sustainability Free Full Text Mechanisms Of Weak Governance In Grasslands And Wetlands Of South America Html

![]()

Yield Based Flip And Partnership Allocation Generally For Wind Projects Edward Bodmer Project And Corporate Finance

Blog Fintech Forum Europe Since 2013 Award Winning Insights On What S Next In European Fintech From The Startups Investors And Financial Institutions Making It Happen

:max_bytes(150000):strip_icc()/Personal-loans-111715-final-3c39d6d214e44604bdc1efca2525d37d.png)

When Are Personal Loans A Good Idea

Negative Net Working Capital For Your Business Good Or Bad Cfo Bridge

Yield Based Flip And Partnership Allocation Generally For Wind Projects Edward Bodmer Project And Corporate Finance

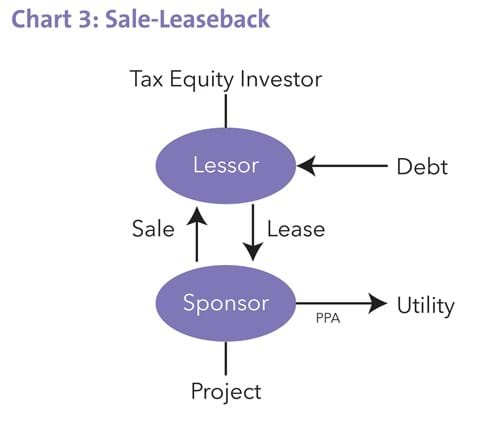

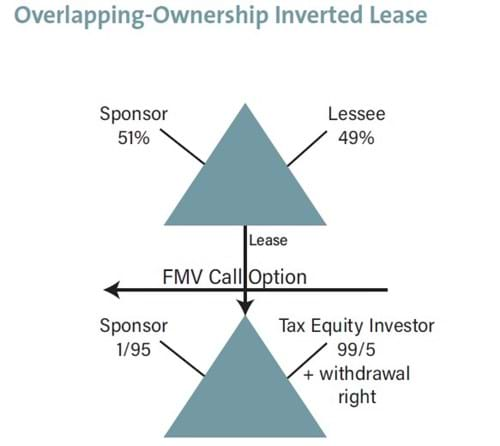

Solar Tax Equity Structures Norton Rose Fulbright September 2015

Financing Structures For Renewable Eneryg Project Financing Renewable Energy Projects

Blog Fintech Forum Europe Since 2013 Award Winning Insights On What S Next In European Fintech From The Startups Investors And Financial Institutions Making It Happen

Solar Tax Equity Structures Norton Rose Fulbright December 2021

Tax Equity Model With Fixed Flip Date Generally For Solar Projects Edward Bodmer Project And Corporate Finance

Financial Statement Analysis And Financial Ratios For Project Finance Ppt Download

Yield Based Flip And Partnership Allocation Generally For Wind Projects Edward Bodmer Project And Corporate Finance

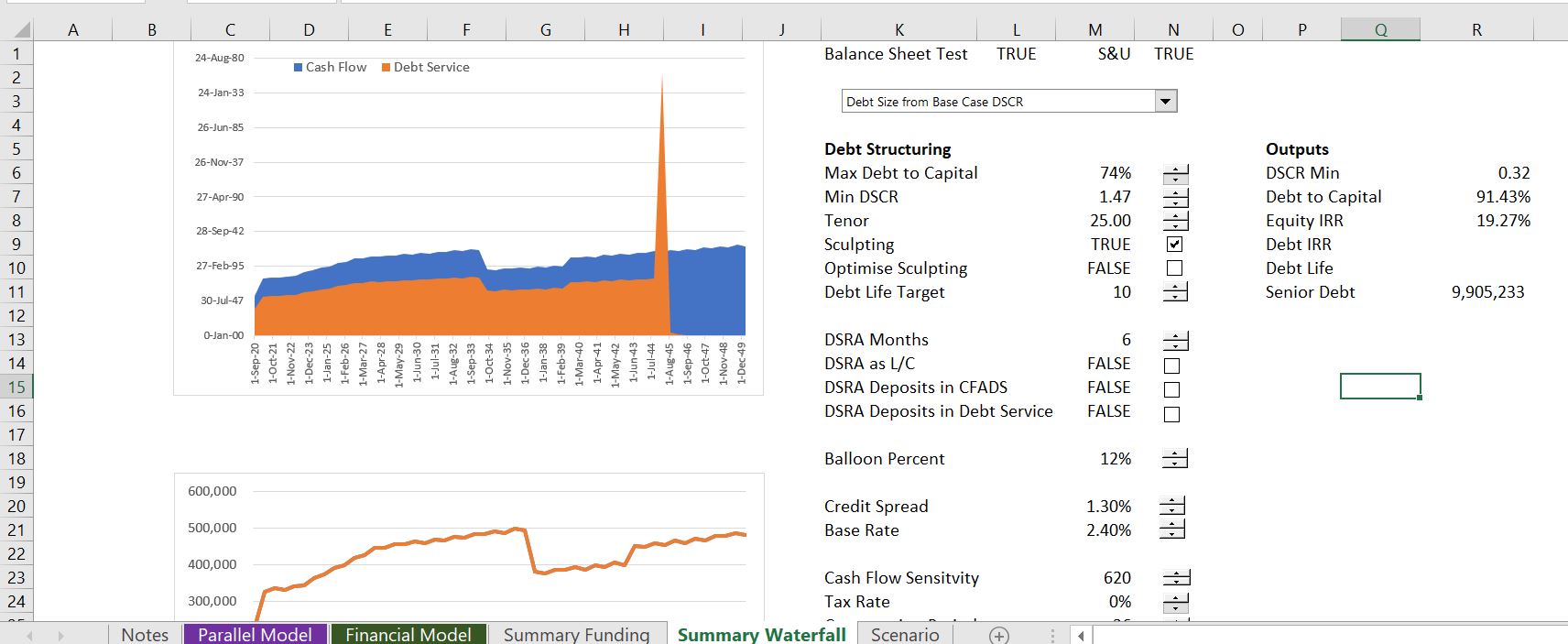

Funding And Equity Bridge Loan Edward Bodmer Project And Corporate Finance

The Project Finance Law Review The Law Reviews

Equity Bridge Loans Ebl Edward Bodmer Project And Corporate Finance

Yield Based Flip And Partnership Allocation Generally For Wind Projects Edward Bodmer Project And Corporate Finance